Stay compliant with 2025 Medicare Part B updates for PTs. Learn the new PTA supervision & plan of care rules to prevent claim denials and reduce audit risks.

Medicare Part B billing can feel like a maze for physical therapists, occupational therapists, and clinic billing managers. Between ever-changing regulations, documentation nuances, and the fear of denials or audits, even small mistakes can cost clinics significant revenue. This guide breaks down the essentials of Medicare Part B billing guidelines for PTs—what you need to know to stay compliant, efficient, and confident in your billing practices.

Understanding Medicare Part B Coverage for Physical Therapy

Medicare Part B covers medically necessary outpatient physical therapy services provided by licensed PTs, OTs, and qualified PTAs working under supervision.1 Covered services include therapeutic exercise, neuromuscular re-education, therapeutic activities, manual therapy, and modalities, as long as they meet the criteria for medical necessity and are properly documented.

Under Part B, Medicare reimburses services that help patients regain function, reduce pain, and improve mobility following injury, surgery, or illness. However, coverage is contingent upon the therapist’s ability to demonstrate skilled, reasonable, and necessary care.

Documentation: The Foundation of Compliance

Accurate documentation is your clinic’s strongest defense against denied claims and audits. Every visit must include:

- Initial Evaluation: A defensible evaluation documenting medical necessity, objective findings, and treatment goals.

- Plan of Care (POC): Signed and dated by the physician or non-physician practitioner within 30 days of the evaluation.

- Daily Notes: Detailing interventions, time spent, patient response, and progress toward goals.

- Progress Reports: Completed at least every 10 visits or 30 days, whichever comes first.

If you’re unsure about what’s considered compliant, review our guide on CPT documentation best practices, which walks through how to document effectively for maximum reimbursement and compliance.

Billing Codes and Modifiers: Accuracy Matters

Billing accuracy starts with correct CPT code selection and modifier usage. Untimed codes (like evaluations) are billed once per session, while timed codes (such as 97530 for therapeutic activities) follow the 8-minute rule for calculating billable units.2

Common modifiers include:

- KX Modifier: Used when a patient surpasses the therapy threshold (formerly the therapy cap), confirming continued medical necessity.

- 59 Modifier: Indicates a distinct procedural service, preventing denials caused by National Correct Coding Initiative (NCCI) edits.

- CQ Modifier: Denotes when services are provided in part by a PTA, ensuring compliance with supervision and billing requirements.

The 8-Minute Rule and Billing Thresholds

Medicare’s 8-minute rule governs how many billable units you can claim for time-based codes. If you perform a timed service for 8 to 22 minutes, it counts as one unit; 23 to 37 minutes equals two units, and so forth.3 Accurate time tracking ensures full reimbursement without overbilling.

Medicare also sets annual therapy thresholds, which are periodically updated. When a patient exceeds the limit, appending the KX modifier confirms that services remain medically necessary and justified.

Demonstrating Medical Necessity

Auditors often flag claims not because the therapy was ineffective, but because the documentation failed to prove medical necessity. To avoid this, tie every treatment to functional outcomes. Clearly link goals to measurable changes—improved gait speed, increased range of motion, or reduced pain scores.

For example, rather than stating “patient performed leg exercises,” describe the activity’s purpose: “Patient performed resisted leg extensions to improve quadriceps strength for stair navigation.” This specificity builds a strong case for skilled care and supports reimbursement under Medicare Part B billing requirements.

Avoiding Common Billing Errors

Even experienced clinics can fall into billing traps. The most frequent issues include:

- Incomplete or vague documentation

- Incorrect CPT or modifier usage

- Duplicate billing from overlapping codes

- Failure to meet supervision rules for PTAs

To minimize risk, implement claim-scrubbing software or use EMRs designed for therapy practices. For a broader strategy on optimizing payment and compliance, check out our post on maximizing payment while protecting your practice.

Audit Risks and Red Flags

Audits are stressful but avoidable. Red flags that may trigger one include:

- Excessive use of high-level CPT codes

- Repetitive billing without documented progress

- Overuse of group or concurrent therapy codes

- Frequent modifier 59 or KX usage

If an audit notice arrives, respond promptly with detailed documentation. Keep organized records of evaluations, daily notes, progress reports, and physician signatures. A well-documented paper trail is your best audit defense.

PTA Supervision and Billing Under Medicare Part B

PTAs play a vital role in patient care, but their involvement affects billing. Under Part B, when a PTA provides more than 10% of a service, the CQ modifier must be appended to the claim.4 PTAs must work under the direct supervision of a licensed therapist, and documentation must clearly reflect who performed each intervention.

Understanding these supervision and billing nuances ensures compliance and prevents payment reductions for assistant-provided services.

Appealing Denied Claims

When Medicare denies a claim, don’t panic. The redetermination process allows you to appeal within 120 days of the decision. Review the denial reason, correct any documentation or coding errors, and resubmit with supporting evidence. Always keep detailed correspondence and claim history for reference.

For recurring denials, conduct internal audits to identify trends—whether certain CPT codes, clinicians, or payers are consistently involved. Addressing systemic issues early can save your clinic time and money.

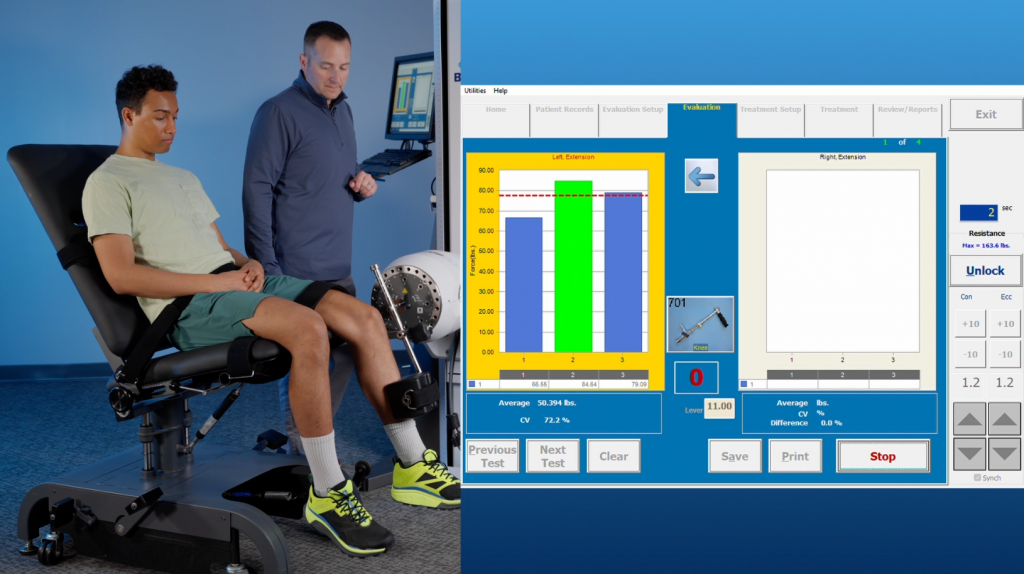

Simplify Medicare Part B Billing with BTE

At BTE, we understand how complex Medicare Part B billing guidelines for PTs can be. Our systems and resources are designed to make your job easier. From objective documentation tools that strengthen claims to data-driven reporting that supports medical necessity, BTE helps clinics stay compliant and profitable.

With our integrated rehab technology, you can:

- Document progress objectively and efficiently

- Reduce audit risk through standardized reporting

- Maximize reimbursement accuracy

Navigating Medicare doesn’t have to be overwhelming—partner with BTE to simplify compliance and focus more on what matters: patient outcomes.

Morgan Hopkins, DPT, CMTPT is a Physical Therapist and freelance healthcare writer. She spent over eight years treating patients in outpatient orthopedics before transitioning to medical writing. Her clinical specialties include intramuscular dry needling, dance medicine, and sports medicine. Morgan is extremely passionate about holistic wellness, preventative care and functional fitness and uses writing to educate and inspire others.